Singapore offices boosted by the new economy

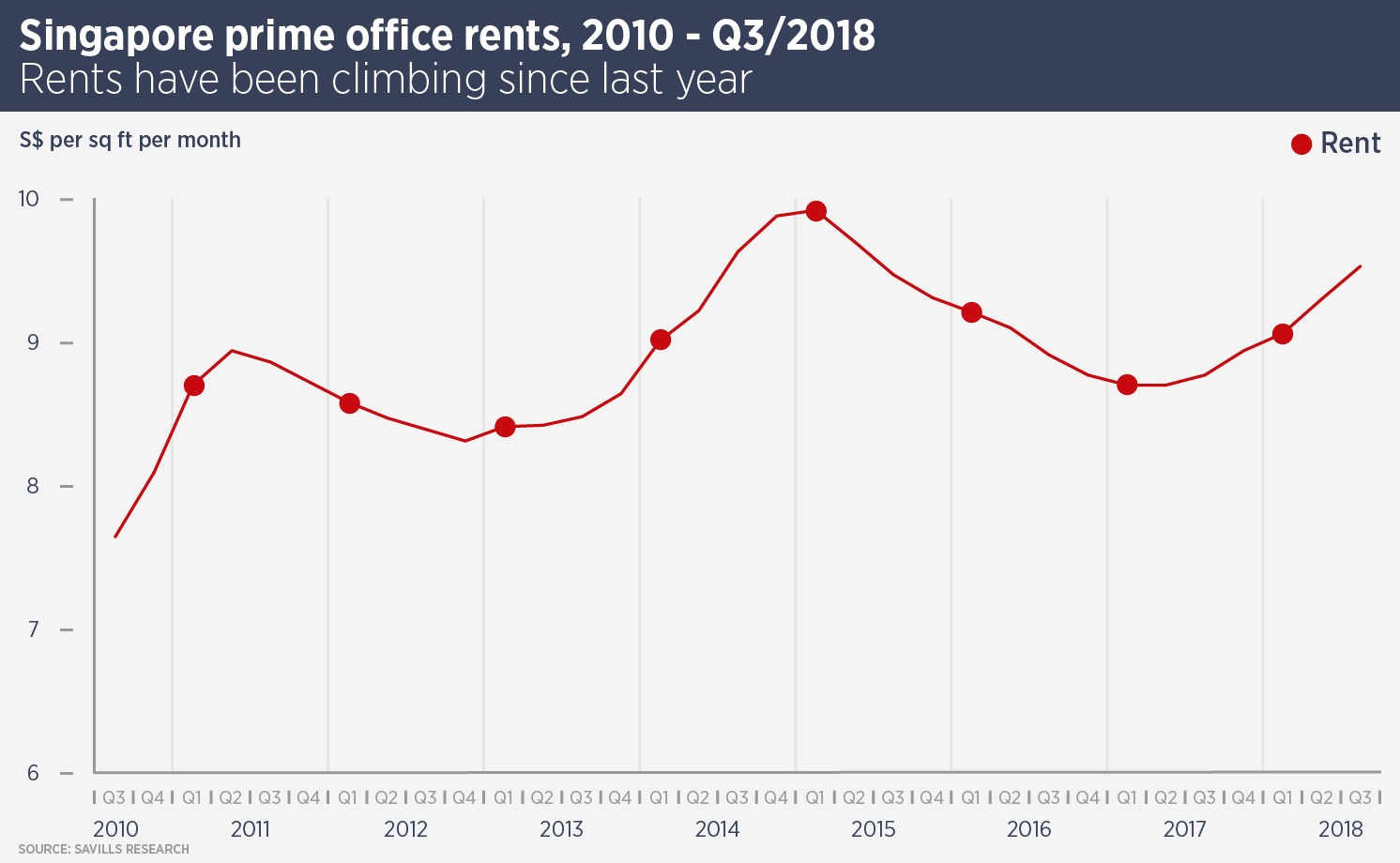

Tight supply and demand from new tenants are pushing office rents up in Singapore and attracting the interest of cross-border capital.

Savills research shows CBD office rents rose 2.5% during the third quarter of this year and have risen 6.6% year-to-date. Alan Cheong, head of research and consultancy at Savills Singapore reckons office rents will rise 10% this year and 8%-10% in 2019.

For the past two years, co-working companies have been driving the office rental market, taking more than 1m sq ft of office space – about half of which is prime space – since the beginning of 2017. However, Cheong believes the sector will not maintain its pace of leasing in 2019 and 2020: “Demand from co-working space operators will be more subdued, and will mainly be from companies looking to move rather than from new entrants.”

Looking ahead, the technology, media and telecoms sector is becoming a more and more important part of the office occupier market. Singapore continues to grow its ecosystem of tech companies, in particular fintech start-ups. This trend is supported by the Singapore government, which is keen for the city-state to become a global hub for fintech.

The supply side is also positive: Singapore is not expected to see significant Grade A office supply until 2022, when IOI Properties and Hongkong Land’s development in Marina Bay and Guocoland’s Beach Road project are completed, delivering more than 2m sq ft of new space.

Expectant investors have been targeting Singapore offices since Asia Square Tower 1 was sold to Qatar Investment Authority in 2016, but buying continued in the third quarter of this year, with AEW Asia buying 55 Market Street in Raffles Place for S$216.8m or S$3,020 per sq ft, reflecting a net yield of 1.7%. AEW bought 20 Anson in June for $516m, also off a keen yield, suggesting the US investment manager still sees opportunities for income growth.

Also in the third quarter, Blackrock bought seven strata floors in Prudential Tower for around S$130m, in the expectation that price per sq ft would improve.

Cheong says: “Our latest on-the-ground feedback suggests CBD Grade A office building rents are still trending up for the short to medium term. Landlords are at the moment confident demand from the TMT sectors will remain strong. In the investment market, the lack of available stock is frustrating investors and so when any building comes up for sale, interest will be high.”

Contact us:

Alan Cheong