Three of Asia real estate’s bright spots

Rising inflation and recession in the US and Europe are casting a shadow over global real estate markets and Asia Pacific has not been immune to the same forces pummelling other regions.

Rising inflation and recession in the US and Europe are casting a shadow over global real estate markets and Asia Pacific has not been immune to the same forces pummelling other regions.

However, stronger growth prospects and the sheer diversity of Asia’s economies, and cities mean there are pockets of positivity all over the region. Prospects highlights three of these: Vietnam, Singapore and Japan.

“These are just some of the bright spots to be found in Asia Pacific real estate, but they are not the only ones,” says Simon Smith, Head of Research and Consultancy, Asia Pacific, at Savills. “There are positive stories to be found in sectors and markets all over the region.

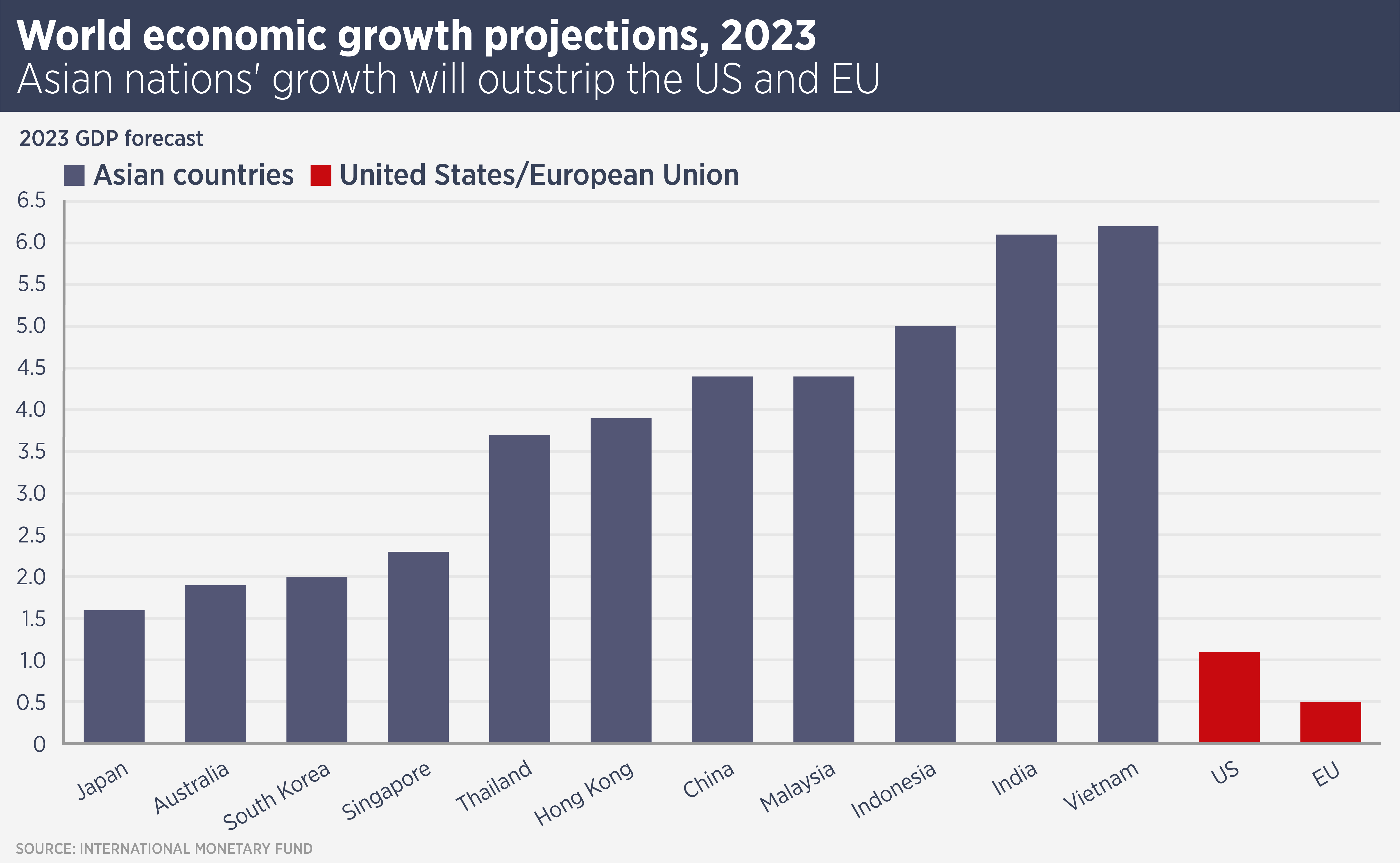

“For example, despite the tough times for the Hong Kong economy and real estate market, the IMF is predicting a strong bounce back to growth in 2023, after a forecast of falling GDP this year.”

Emerging Asian economies such as China, Vietnam, Indonesia and India are forecast to lead global growth in 2023 and even the developed economies of Australia and Japan are set to outstrip the US and EU by a considerable amount.

Vietnam

Growing foreign direct investment and government reforms are boosting overseas interest in the Vietnamese real estate market. While some domestic developers are finding life difficult due to tightened credit controls, overseas capital continues to be active. For example, Singapore’s CapitaLand announced earlier this year that it would buy a site in Ho Chi Minh City for a $1 billion mixed-use development.

Furthermore, Savills data for the third quarter of this year show CBD office and retail rents are rising in Hanoi and Ho Chi Minh City. The industrial and logistics sector is seeing investment from manufacturers looking to diversify their operations in a “China-plus” strategy.

“Vietnam is on course for growth in 2022, with rising FDI and a strong domestic economy,” says Troy Griffiths, Deputy Managing Director at Savills Vietnam. “The Vietnamese government is also introducing a series of measures to improve real estate transparency, which bode well for future liquidity and investability. It is also investing in infrastructure. We are seeing continued investor interest in a number of sectors.”

Singapore

MSCI Real Assets recorded $9.1 billion of real estate investment deals in the first three quarters of this year, up an astonishing 47% from the same period in 2022.

Savills research reports rising rents in the CBD office sector amid falling vacancy, despite concerns about the global economy and in particular the technology sector, which has become a major occupier in Singapore.

The city’s residential rental sector is booming, with the Urban Redevelopment Authority rental index for all private residential properties jumping 8.6% quarter-on-quarter in the third quarter, the highest quarterly increase for 15 years.

Rents for logistics properties also rose 2.8% in the third quarter and Savills research is predicting further rises next year. “Notwithstanding global economic problems, local industrial and warehouse rents are expected to rise in 2023,” says Alan Cheong, Head of Singapore Research and Consultancy at Savills.

Japan

While real estate investors in most of the world battle with rising finance costs, the Bank of Japan has not chosen to raise interest rates, meaning attractive finance deals are still available. Projected GDP growth of 1.6% next year is well under-pinned by developed nation standards and the weak Japanese yen means assets look cheap for foreign buyers.

“Japan continues to attract overseas investors due to the positive spread between debt costs and yields. The multifamily and logistics sectors continue to be favourites, however there is also more interest in offices and in the recovering hospitality sector,” says Tetsuya Kaneko, Head of Research and Consultancy at Savills Japan.

The multifamily sector is regarded as being one of the most resilient in uncertain economic times and has been very popular with foreign investors. Four of the top five buyers of Japanese multifamily in the past five years were foreign investors, data from MSCI Real Assets show. Between them, Blackstone Group, Allianz Real Estate, AXA IM and Nuveen have invested circa ¥800 billion ($5.75 billion) in the sector.

Foreign investors were amongst the bidders for the Japanese Ministry of Finance’s share of the Otemachi Place office tower in Tokyo. However, they were beaten by a domestic consortium which paid ¥436.4 billion ($3.13 billion), a new record for Japanese property.

Further reading:

Asia Pacific Investment Quarterly Q3 2022

Contact us:

Troy Griffiths | Tetsuya Kaneko