Tough outlook for fund-raising, after record inflows

Capital raising for real estate private equity funds is set to become harder as rising interest rates put pressure on sector performance.

Capital raising for real estate private equity funds is set to become harder as rising interest rates put pressure on sector performance.

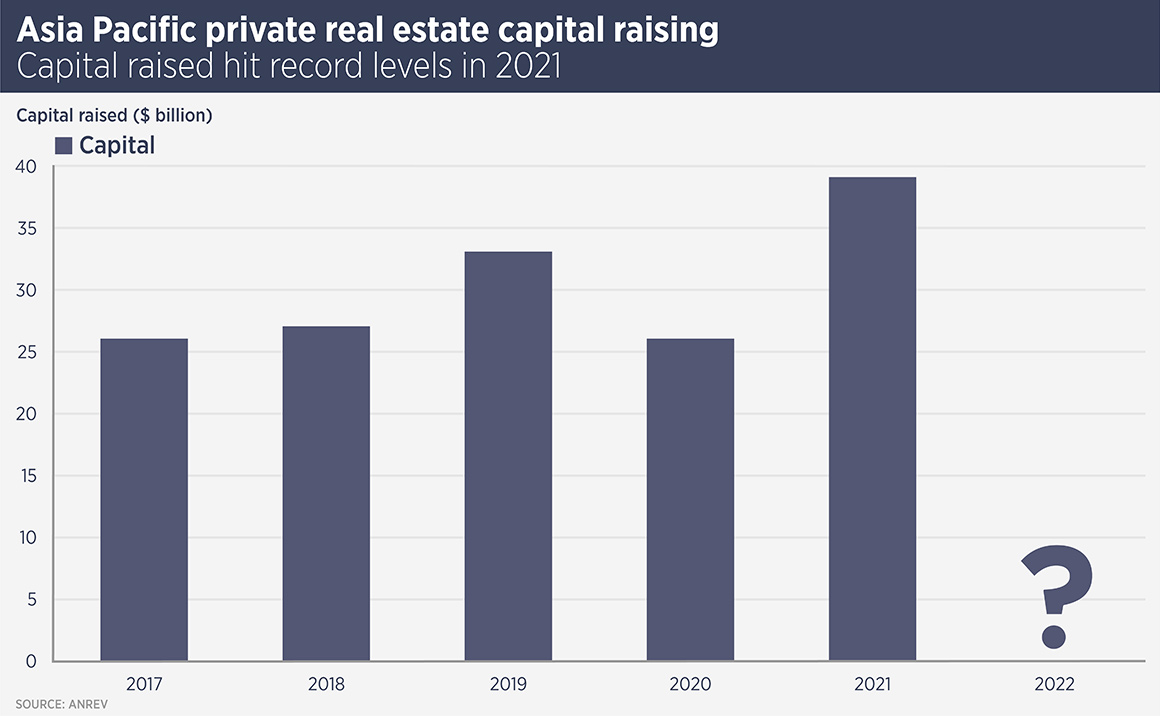

Data from ANREV, the Asian real estate funds body, show 2021 was a record year for Asia Pacific fund raising, and 2022 has seen some substantial fund closings, however investment managers do not believe the momentum can be maintained into 2023.

“Global economic concerns mean institutional investors will be more reluctant to commit to new investments at the moment,” says Simon Smith, Head of Research and Consultancy, Asia Pacific, at Savills. “Rising interest rates and inflation are affecting decision-making across all asset classes.”

Overall real estate capital raising hit a record $288 billion in 2021, according to the ANREV/INREV/NCREIF Capital Raising Survey 2022, with capital raised for Asia-Pacific strategies up 49% to $38.9 billion.

This year has seen a number of large Asia Pacific funds closed, including LaSalle Investment Management’s sixth Asia opportunity fund, which raised $2.2 billion in September, while logistics specialist GLP raised just over $10 billion in three funds. The market has also been positive enough for first time funds, such as Seven Seas Advisors’ first Japan private equity fund, which raised $125 million.

Blackstone Group announced in October that it has so far raised $7.8 billion for its latest Asia real estate fund, which will swell the overall 2023 data if it closes next year.

However, data provider Preqin reports that global real estate private equity fundraising in the first half of this year fell well below both 2021 and 2020 levels and predicts that the 2021 record will not be matched for several years.

The denominator effect, by which the relative weighting of one asset class rises because of falling values in another, means many institutional investors are now at the top of their allocation to real estate, due to falling share prices worldwide. This will discourage new real estate investment but is unlikely to force investors to sell assets.

Additionally, the listed real estate sector is likely to see more capital in the short term, as investors look to take advantage of falling share prices for developers and real estate investment trusts. The FTSE EPRA Nareit Asia Pacific Index is down nearly 16% this year.

However, the ANREV/INREV/NCREIF Investment Intentions survey for 2022, released earlier this year, saw Asia Pacific named the preferred region for investors who plan to increase their real estate allocations. While those allocation plans might have changed, the preference for Asia Pacific is unlikely to fade.

“This region’s demographics and growth prospects still lead the rest of the world,” says Smith. “This suggests a relatively positive outlook for fund raising even in difficult times. Moreover, the volume of capital raised in recent years means that there is a lot of dry powder ready to be invested in Asia Pacific real estate.”

Further reading:

Savills Asia Pacific Investment Quarterly

Contact us:

Simon Smith